The transition to what has been called a ‘post-growth’ economy in advanced economies could lead to an uncomfortable policy choice between a fiscal contraction and a spiralling public debt-to-GDP ratio. This choice is particularly severe in the context of various long-term structural issues such as demographic change, geopolitical uncertainty and the costs of mitigating (or adapting to) climate change – all of which are expected to place significant pressure on public finances. When the real economic growth rate exceeds the interest rate on government debt, the public debt-to-GDP ratio tends to stabilise or fall irrespective of the size of the debt ratio. But when the growth rate falls below the interest rate, the trajectory of the public debt ratio shifts from stabilisation to limitless increase, unless offset by contractionary fiscal policies. In other words, a post-growth economy may find itself torn between austerity and the emergence of unsustainable increases in the public debt ratio. This tension, in turn, underscores the challenges of delivering on ideas such as ‘prosperity without growth‘ and ‘welfare without growth‘.

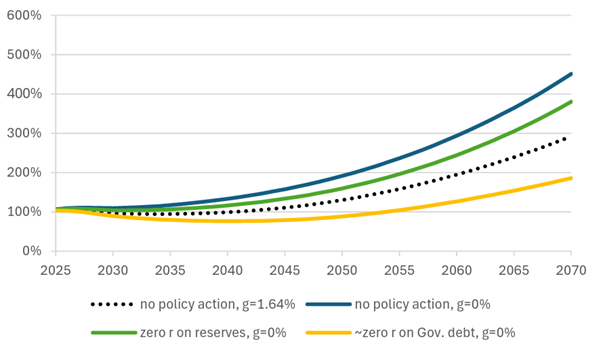

This post-growth challenge is likely to be compounded by a variety of structural changes in advanced economies which are expected to drive significant increases in public debt ratios, even without a slowdown in economic growth. These include the transition to net zero, rising geopolitical tensions, technological advancement, and – most significantly over the longer term – ageing populations. Indeed, projections suggest that demographic factors could cause public debt ratios to reach up to 600% by the 2070s, depending on the country and scenario. Combined, the post growth and long run structural challenges facing advanced economies raise important questions about the design of the macroeconomic policy framework.

In the conventional approach to macroeconomic policy, increasing public debt ratios (whether caused by an increase in the real interest rate above the real growth rate or an increase in the structural deficit) are meant to be addressed via contractionary fiscal policy. Conversely, in some ‘alternative’ approaches to macroeconomic policy, such as Functional Finance, increasing debt ratios are meant to be addressed via an expansionary monetary policy that lowers the real interest rate below the real growth rate.

However, both the conventional and alternative approaches come with significant drawbacks. In the conventional approach maintaining a balanced budget may constrain the government’s capacity to provide essential public services and address long run structural economic challenges – especially given the sheer size of the fiscal tightening that will be required to stabilise the debt ratio. Meanwhile, under an alternative approach using monetary policy to target debt sustainability would both undermine its role in managing aggregate demand and would also be unlikely to prevent substantial increases in the debt ratio, given the size of the expected increases in fiscal deficits. Despite the potentially significant impacts of a post-growth transition on debt ratios, particularly when combined with the economic challenges facing advanced economies, the post-growth literature has largely overlooked how such a transition might affect the sustainability of the public finances or potential policy responses.

This paper seeks to address this gap by exploring how a post-growth environment could influence public debt dynamics, especially in light of the long-term structural challenges discussed earlier, and also by assessing the effectiveness of various approaches to monetary and fiscal policy in managing both public debt and aggregate demand. In particular, we examine whether a post-growth transition necessitates rethinking the current orthodox policy framework, in which monetary policy primarily manages demand while fiscal policy addresses public debt. We consider three alternative approaches alongside the orthodox approach: i) An orthodox approach combined with unconventional monetary policies, in which monetary policies manage demand but also contribute to debt management; ii) A functional finance approach, in which monetary policy is applied to debt sustainability and fiscal policy is used to manage demand; and iii) What we call a ‘flexible finance’ approach, in which monetary policy tools are integrated into the functional finance framework and both fiscal and monetary policies are coordinated for debt sustainability and demand management purposes.

Using the UK as a case study, we analyse both the implications of different policy approaches for the public debt ratio and the extent of the policy response needed to stabilise the public debt ratio. Our analysis reveals that stabilising debt ratios will be challenging regardless of the level of economic growth. However, more adaptable monetary and fiscal policy frameworks necessitate less drastic interventions (e.g. with regards to fiscal surpluses or interest rates), thereby limiting negative economic repercussions compared to traditional approaches. Similarly, relaxing debt and inflation targets moderates the scale of required policy adjustments. Nonetheless, both increased policy flexibility and more lenient targets involve trade-offs, reinforcing the idea that there are no easy solutions for the long run structural pressures facing many advanced economies.

The full article may be cited as:

Jackson, A., & Jackson, T. (2025). Public debt and the post-growth challenge: the case for a flexible monetary and fiscal policy framework. CUSP Working Paper No. 43. Guildford: Centre for the Understanding of Sustainable Prosperity.